It is a nice coincidence that Glenn Beck would introduce us more closely to the U.S. Federal Reserve one day before the Rockin’ Conservative delved into The Fed. Part of Glenn’s program discussed a book “The Creature From Jekyll Island” by G. Edward Griffin that, among other things, chronicled the creation of the Federal Reserve System at a meeting of powerful financial magnates at Jekyll Island in southern Georgia.

“On the evening of November 22, 1910, Sen. Aldrich and A.P. Andrews (Assistant Secretary of the Treasury Department), Paul Warburg (a naturalized German representing Baron Alfred Rothschild’s Kuhn, Loeb & Co.), Frank Vanderlip (president of the National City Bank of New York), Henry P. Davison (senior partner of J. P. Morgan Company), Charles D. Norton (president of the Morgan-dominated First National Bank of New York), and Benjamin Strong (representing J. P. Morgan), left Hoboken, New Jersey on a train in view of a group of confused reporters, who were wondering why these bankers, representing about one-sixth of the world’s wealth, were gathering at this particular place and time and leaving together.”

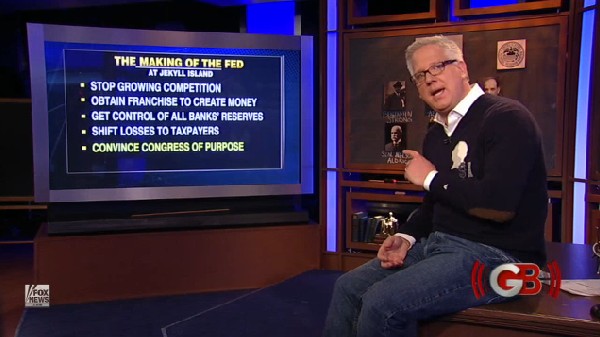

According to Beck, the 5 goals of the participants were to:

I strongly recommend that you read the transcript of Beck’s program from 3/25/11 when it becomes available

Today, we are going to meet The Fed. We’ll take a quick look at the Board Of Governors of The Fed, and give a quick hit about each member:

We all know the Chairman, Ben Bernanke. Dr. Bernanke has been hailed as an expert on the Depression of  the 1930’s and decried for his handling of the current economic downturn.

the 1930’s and decried for his handling of the current economic downturn.

Ron Paul said of Dr. Bernanke, “There is something fishy about the head of the world’s most powerful government bureaucracy, one that is involved in a full-time counterfeiting operation to sustain monopolistic financial cartels, and the world’s most powerful central planner, who sets the price of money worldwide, proclaiming the glories of capitalism.”

Senator Jim Bunning of Kentucky said on CNBC that he had seen documents which show Bernanke overruled recommendations from his staff in bailing out AIG. The columnist says this raises questions as to whether or not the decision to bail out AIG was necessary.

The Vice Chairman is Janet Yellen. Dr. Yellen was making a tidy $410,000 as the San Francisco Fed President in 2009, while Dr. Bernanke’s salary is controlled by law. Yes, friends. That $410,000 is coming out of your pockets. She apparently co-authored an interesting discussion of Out-Of-Wedlock Marriage with her husband, George Akerlof.

The Vice Chairman is Janet Yellen. Dr. Yellen was making a tidy $410,000 as the San Francisco Fed President in 2009, while Dr. Bernanke’s salary is controlled by law. Yes, friends. That $410,000 is coming out of your pockets. She apparently co-authored an interesting discussion of Out-Of-Wedlock Marriage with her husband, George Akerlof.

She believes low interest rates can be problematic, but she has NEVER voted against the majority in 36 policy decisions.

In the light review of Dr. Yellen’s history, I do not find any employment in the real world. Bernanke waited tables to help get through college.

You don’t have to dig very far into The Fed to find the fingerprints of Morgan Stanley. It seems that behemoth, along with Goldman Sachs, is  a revolving door for the financial control of the U.S. Meet Kevin Warsh who joined The Fed in 2006. At that time, Vice Chairman Preston Marsh said Warsh’s nomination was “not a good idea” and that if he had a voice in the Senate, he would vote no.

a revolving door for the financial control of the U.S. Meet Kevin Warsh who joined The Fed in 2006. At that time, Vice Chairman Preston Marsh said Warsh’s nomination was “not a good idea” and that if he had a voice in the Senate, he would vote no.

However, Mr. Warsh has resigned from the Board Of Governors effective at the end of March 2011 but is still listed on The Fed’s web site. Sadly, Mr. Warsh was the only dissenting opinion on The Fed’s $600 Billion plan to buy bonds to lower long-term interest rates and stimulate bank lending. President Obama will have another chance to put his stamp on The Fed when replacing Warsh.

Elizabeth A Duke joined The Fed in 2008. On 7/16/09, during Senate testimony, Ms. Duke attempted a claim that the only portion of The Fed over which there is no oversight is ‘monetary policy’. Senator Ron Paul quickly quashed her effort to mis-characterize the level of transparency with 5 activities that spurn oversight — including transactions with other counties’ central banks. Senator Paul compared such transactions to treaties that The Fed was executing without oversight from Congress.

Elizabeth A Duke joined The Fed in 2008. On 7/16/09, during Senate testimony, Ms. Duke attempted a claim that the only portion of The Fed over which there is no oversight is ‘monetary policy’. Senator Ron Paul quickly quashed her effort to mis-characterize the level of transparency with 5 activities that spurn oversight — including transactions with other counties’ central banks. Senator Paul compared such transactions to treaties that The Fed was executing without oversight from Congress.

Later in the questioning, Senator Paul wonders how well the consumer fares in the policy schemes of The Fed noting that the dollar has lost 96% of its value since the creation of The Fed. Ms. Duke simply restates the ‘dual responsibilities’ of The Fed avoiding a real answer to the question.

Elizabeth Duke has predicted 4 Million more foreclosures for 2011 – 2012.

After performing as a trusted Obama adviser during the campaign and terminating his position as Professor of  Law at Georgetown University Law Center, Daniel K. Tarullo joined The Fed in 2009.

Law at Georgetown University Law Center, Daniel K. Tarullo joined The Fed in 2009.

He believes the Government has the right to oversee salaries in the private sector — especially at the banks. Tarullo chairs the committee that oversees banking regulation and has frustrated banking lawyers with a less-than-clear position on “how private equity firms can come into compliance with Fed regulations restricting non-banks from controlling depository institutions. ‘He hasn’t even made one speech about the issue.’”

Sarah Bloom Raskin, the newest member of the Board of Governors joined in late 2010. The Raskin name may ring a bell as her father-in-law is Marcus Raskin who started the Institute for Policy Studies — a notoriously leftist think tank.

Sarah Bloom Raskin, the newest member of the Board of Governors joined in late 2010. The Raskin name may ring a bell as her father-in-law is Marcus Raskin who started the Institute for Policy Studies — a notoriously leftist think tank.

A great workup on the “radical royal family” is here.

In 1978, in an article in National Review, Brian Crozier , director of the London-based Institute for the Study of Conflict described IPS as the ‘perfect intellectual front for Soviet activities which would be resisted if they were to originate openly from the KGB’.”

And, finally, we have a vacant position on the Board waiting to be filled by President Obama and the Senate.  His latest nominee, Peter Diamond, was rejected by by the Senate on August 5, 2010.

His latest nominee, Peter Diamond, was rejected by by the Senate on August 5, 2010.

Diamond is a strong Keynesian policy advocate and will push for more government stimulus rather than relying on the private sector according to Freedom Works.

“In the face of rising oil and food prices, Diamond has expressed no real concern over inflation. On November 30, he told Bloomberg News that ‘the quantitative easing is a help but it needs fiscal backing. Given the other things happening, it’s not as powerful as we need.’ The ramifications of engaging in overly loose monetary policy are hugely negative, affecting both domestic and global markets.“, wrote Freedom Works in a letter to Senators during the Diamond nomination process.

Diamond was awarded the Nobel Prize in Economic Sciences in October 2010, along with Dale T. Mortensen from Northwestern University and Christopher A. Pissarides from the London School of Economics “for their analysis of markets with search frictions”

However, he couldn’t get past the Senate for confirmation to The Fed. But, we know the standards for Nobel Prizes have dropped substantially over the past 10 years.

That’s it. These 7 positions probably have more power than the President and the Congress combined, are effectively negotiating treaties with other governments, and barely any of them have real experience the private sector ‘making things’.

Leave a comment